Quick take

Ruchira Papers Ltd.

BUY

CMP

`188

Creating value through paper

Target Price

`244

Ruchira Papers Limited (RPL) manufactures writing paper, printing paper and Kraft

Investment Period

12 Months

paper. The company's white writing and printing paper is used in making notebooks

and writing material, while the colored paper is used in the fabrication of spiral

Stock Info

notebooks, wedding cards, shade cards, children's coloring books, etc. Its Kraft paper

Sector

Food Processing

is utilised in the packaging industry for making corrugated boxes/cartons and for other

Market Cap (` cr)

421

packaging requirements. The company’s writing and printing paper and Kraft paper is

Net Debt (` cr)

63

manufactured by using agricultural residues like wheat straw, bagasse, sarkanda and

Beta

1.2

other materials.

52 Week High / Low

207/ 100

A vg. Daily Volume

30,145

Healthy demand in paper segment to drive growth: Indian paper industry is estimated

Face Value (`)

10

to grow at a CAGR of 7.6% over the next couple of years, in-line with India’s GDP

BSE Sensex

33,247

growth. Further, Kraft paper segment is also growing at a faster rate due to strong

Nifty

10,252

demand from packaging industry (owing to increasing e-commerce and FMCG

Reuters Code

RCHR.BO

demand). We believe that the company has diversified product portfolio in both the

Bloomberg Code

RUCP.IN

segments, which would assist in capturing growing demand.

Ban in China to boost paper prices: The Chinese Government has banned the import

Shareholding Pattern (%)

of waste paper, which is the primary raw material for finished paper. Thus, the

Promoters

61.1

production of finished paper would be impacted in China. This in turn would lead to

MF / Banks / Indian Fls

0.0

an increase in the prices of finished paper. Eventually, the paper manufacturing

FII / NRIs / OCBs

1.2

companies like RPL would witness volume growth and also benefit due to the increase

Indian Public / Others

37.7

paper prices.

Upgradation of existing units to improve production efficiency: Company has planned

a capex of `42cr (funded by term loan of `27cr and balance through internal accruals)

Abs. (%)

3m 1yr

3yr

for upgradation and modernization of existing units. This will facilitate RPL to introduce

Sensex

3.1

25.0

21.7

new range of value added products in its Kraft paper unit coupled with an increase in

RPL

9.0

82.0

580.0

Paper Machine speed from 640 meters/minute to 700 meters/minute in writing and

printing paper unit. This modernization plan will be implemented in January 2018 and

company will start reaping its benefits from 1QFY2019 onwards. Further, RPL has

plans to setup a green field project in the state of Punjab.

Outlook and Valuation: We forecast RPL to report healthy top-line of ~13% CAGR over

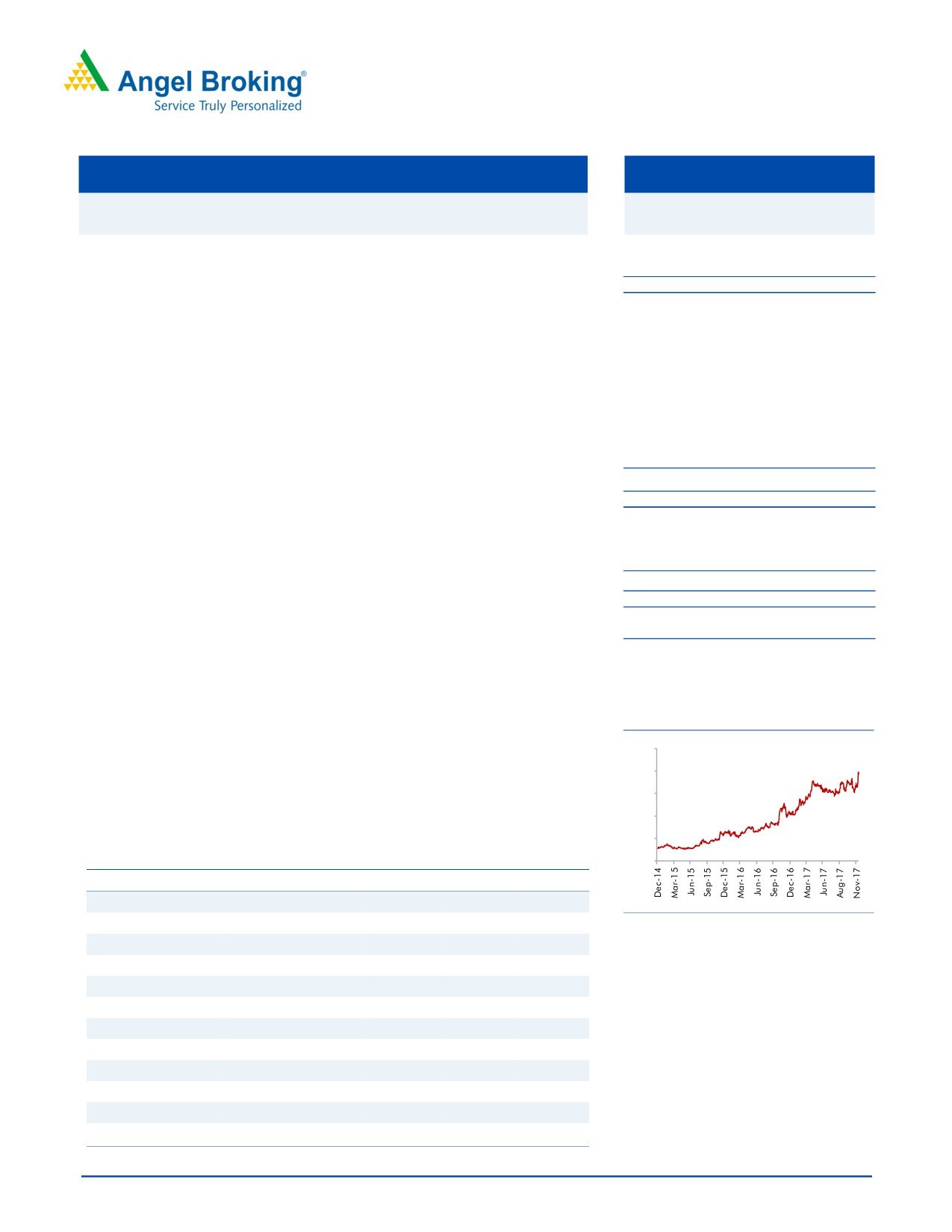

3 year daily price chart

FY17-20E on the back of healthy demand growth in printing & writing paper and Kraft

250

paper. On the bottom-line front, we estimate

~16% CAGR owing to strong

improvement in operating performance. Further, improvement in manufacturing

200

efficiency and benefits from increasing global finished paper prices (ban in China)

150

would aid margins. We initiate coverage on the RPL with a Buy recommendation and

target price of `244 (11x FY2020E EPS), indicating an upside of ~30% from the

100

current levels.

50

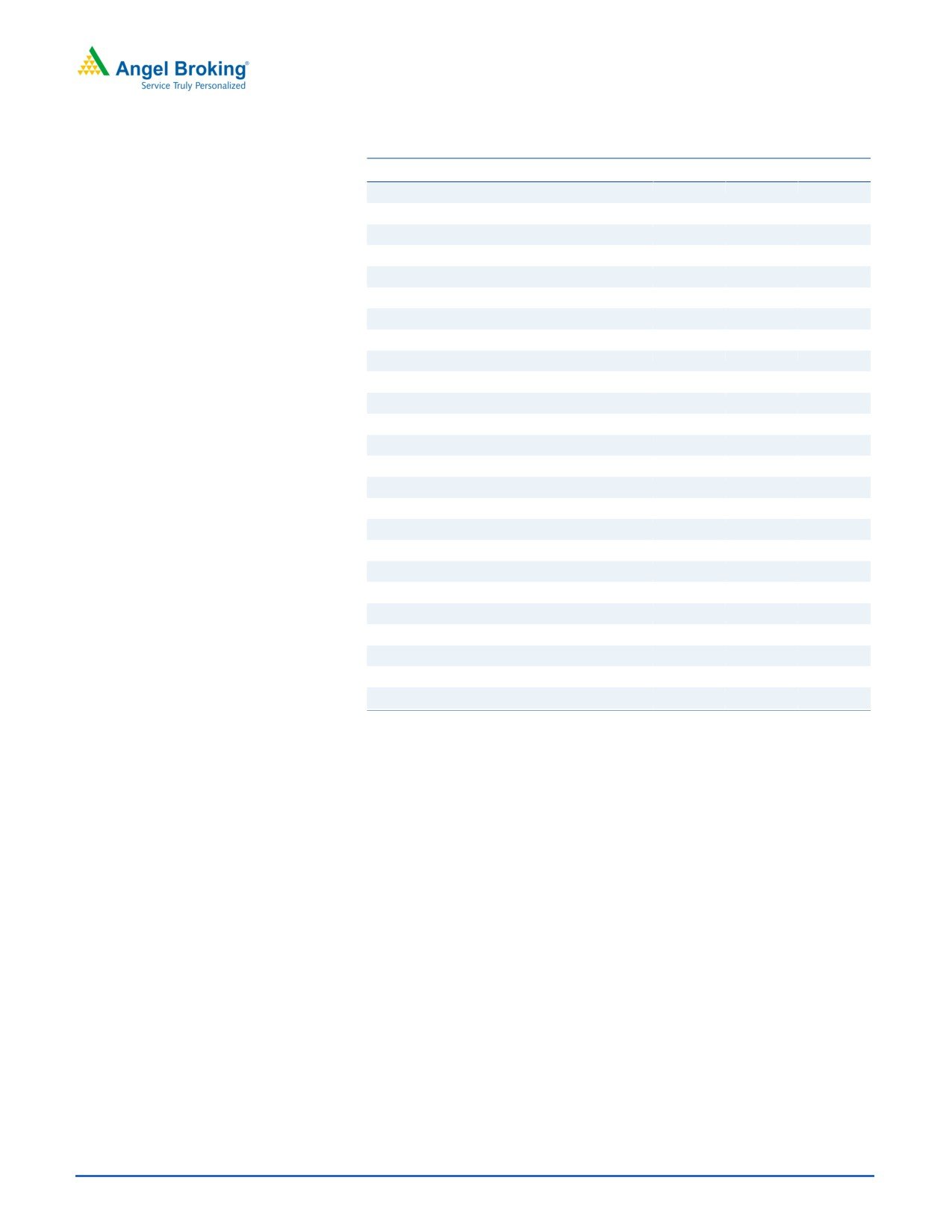

Key financials

0

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E FY2020E

Net Sales

363

416

470

532

603

% chg

4.6

14.8

12.9

13.3

13.3

Source: Company, Angel Research

Net Profit

19

32

37

42

50

% chg

51.0

64.9

15.2

15.0

17.0

OPM (%)

13.1

15.2

15.6

15.6

15.6

Amarjeet S Maurya

EPS (Rs)

8.7

14.3

16.5

19.0

22.2

022-39357800 Ext: 6831

P/E (x)

21.7

13.1

11.4

9.9

8.5

P/BV (x)

3.5

2.8

2.3

1.9

1.6

RoE (%)

16.1

21.0

20.0

19.2

18.7

RoCE (%)

19.6

23.6

22.7

22.8

23.0

EV/Sales (x)

1.4

1.2

1.1

0.9

0.8

EV/EBITDA (x)

10.4

7.7

6.8

5.9

5.1

Source: Company, Angel Research, Note: CMP as of December 14, 2017

Please refer to important disclosures at the end of this report

1

Quick take

Ruchira Papers

Investment Rational

Robust demand in paper segment to drive growth

Indian paper industry is estimated to grow at a CAGR of 7.6% over the next couple

of years, in-line with India’s GDP growth. Further, Kraft paper segment is also

growing at a faster rate due to strong demand from packaging industry (owing to

increasing e-commerce and FMCG demand). We believe that the company has

diversified product portfolio in both the segments, which would assist in capturing

growing demand.

Ban in China to boost paper prices

The Chinese Government has banned the import of waste paper, which is the

primary raw material for finished paper. Thus, the production of finished paper

would be impacted in China. This in turn would lead to an increase in the prices of

finished paper. Eventually, the paper manufacturing companies like RPL would

witness volume growth and also benefit due to the increase paper prices.

Upgradation of existing units to improve production efficiency

Company has planned a capex of `42cr (funded by term loan of `27cr and

balance through internal accruals) for upgradation and modernization of

existing units. This will facilitate RPL to introduce new range of value added

products in its Kraft paper unit coupled with an increase in Paper Machine

speed from 640 meters/minute to 700 meters/minute in writing and printing

paper unit. This modernization plan will be implemented in January 2018 and

company will start reaping its benefits from 1QFY2019 onwards. Further, RPL

has plans to setup a green field project in the state of Punjab.

December 15, 2017

2

Quick take

Ruchira Papers

Company Background

Ruchira Papers Limited (RPL) is an India based company, which manufactures

paper and paper products. The company is engaged in the process of

manufacturing writing and printing paper and Kraft paper. RPL’s white writing

and printing paper is used to make notebooks and writing material, while the

colored paper is used in the fabrication of spiral notebooks, wedding cards,

shade cards, children's coloring books, colored copier paper and bill books. Its

Kraft paper is utilized in the packaging industry for making corrugated

boxes/cartons and for other packaging requirements. The company’s writing

and printing paper is manufactured by using agricultural residues like wheat

straw, bagasse, sarkanda and other materials. Its semi Kraft paper is

manufactured by using agriculture residues like bagasse, wheat straw, rice

straw, sarkanda and indigenous materials, etc. The company offers its

products to customers in India and overseas.

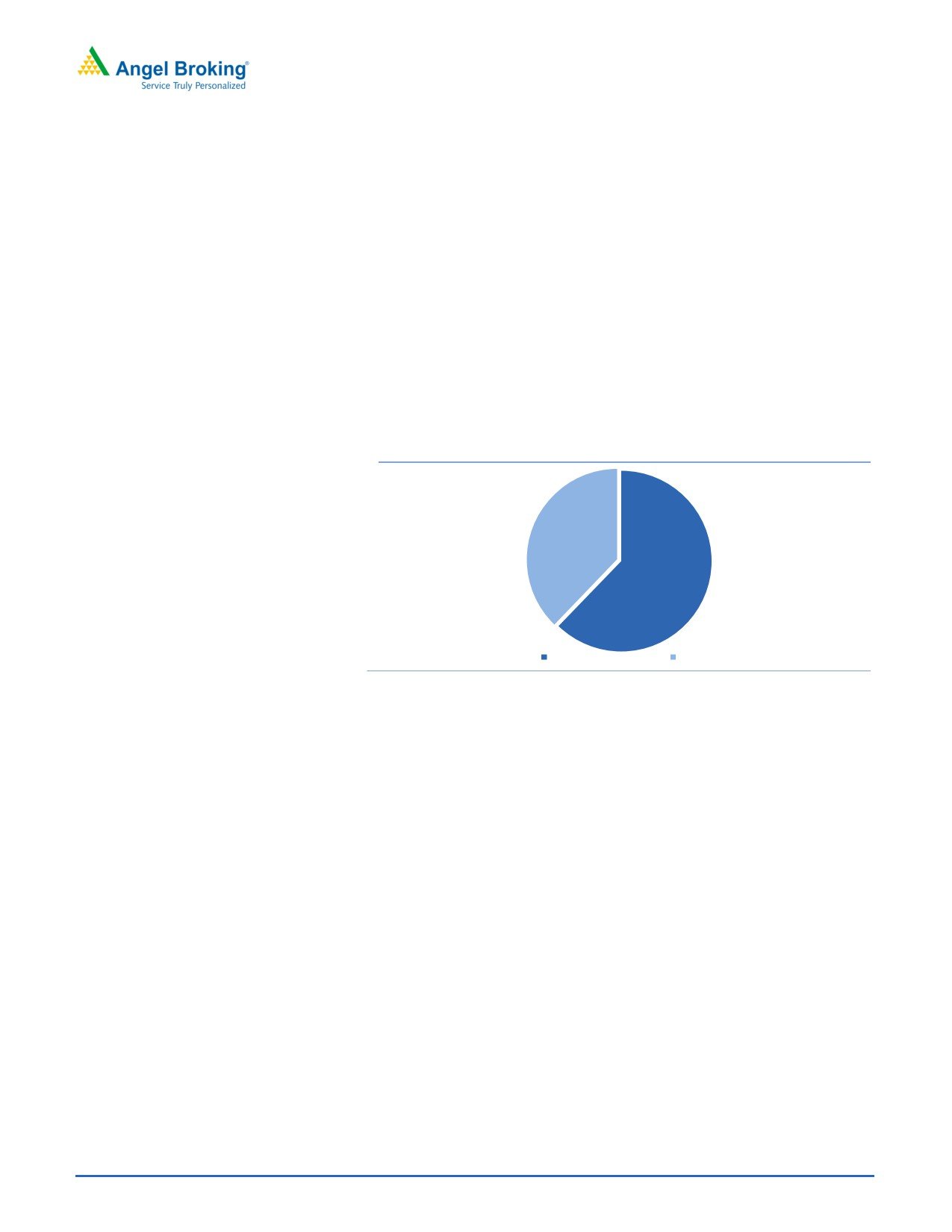

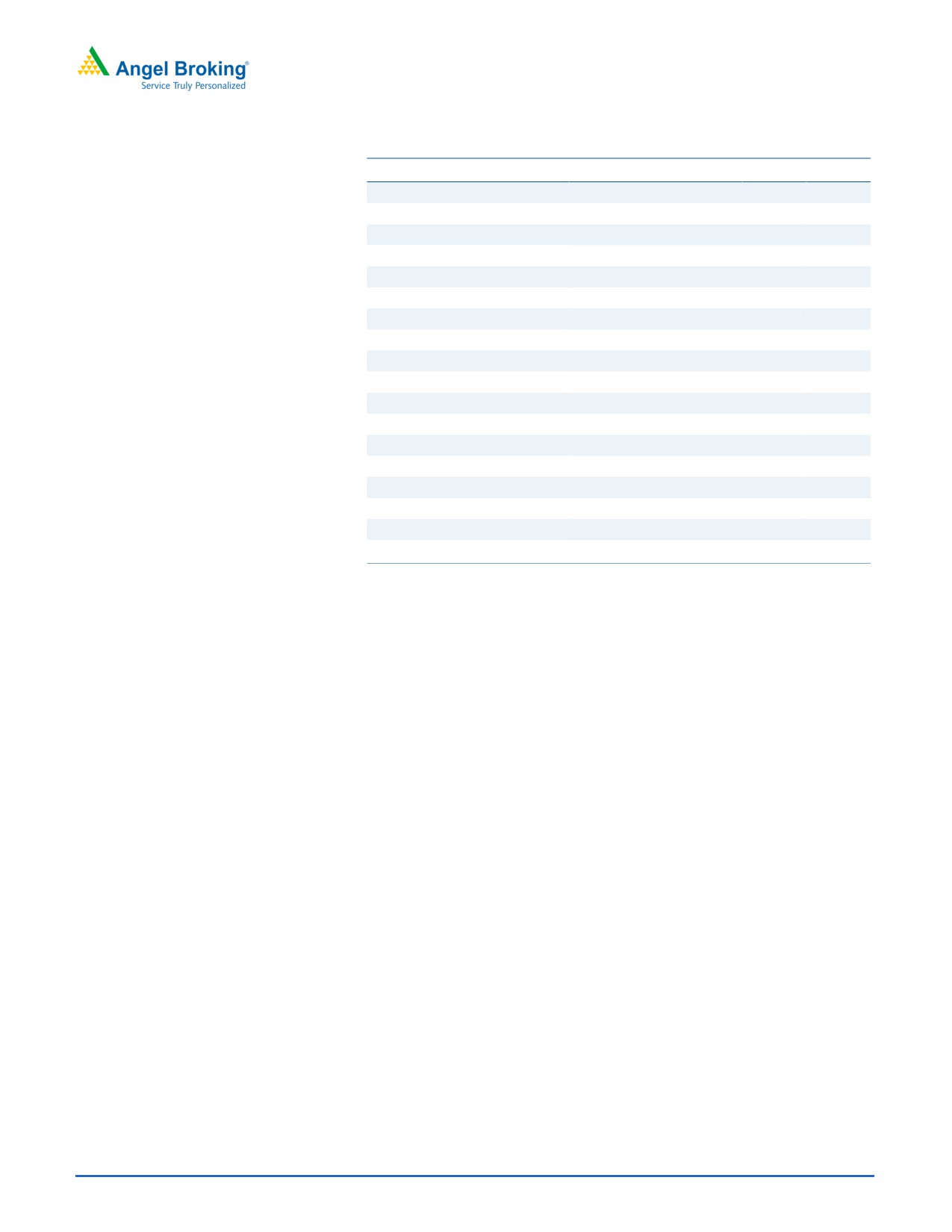

Exhibit 1: Revenue break-up for RPL (FY2017)

37.81%

62.19%

Writing & Printing Paper

Kraft Paper

Source: Company, Angel Research

December 15, 2017

3

Quick take

Ruchira Papers

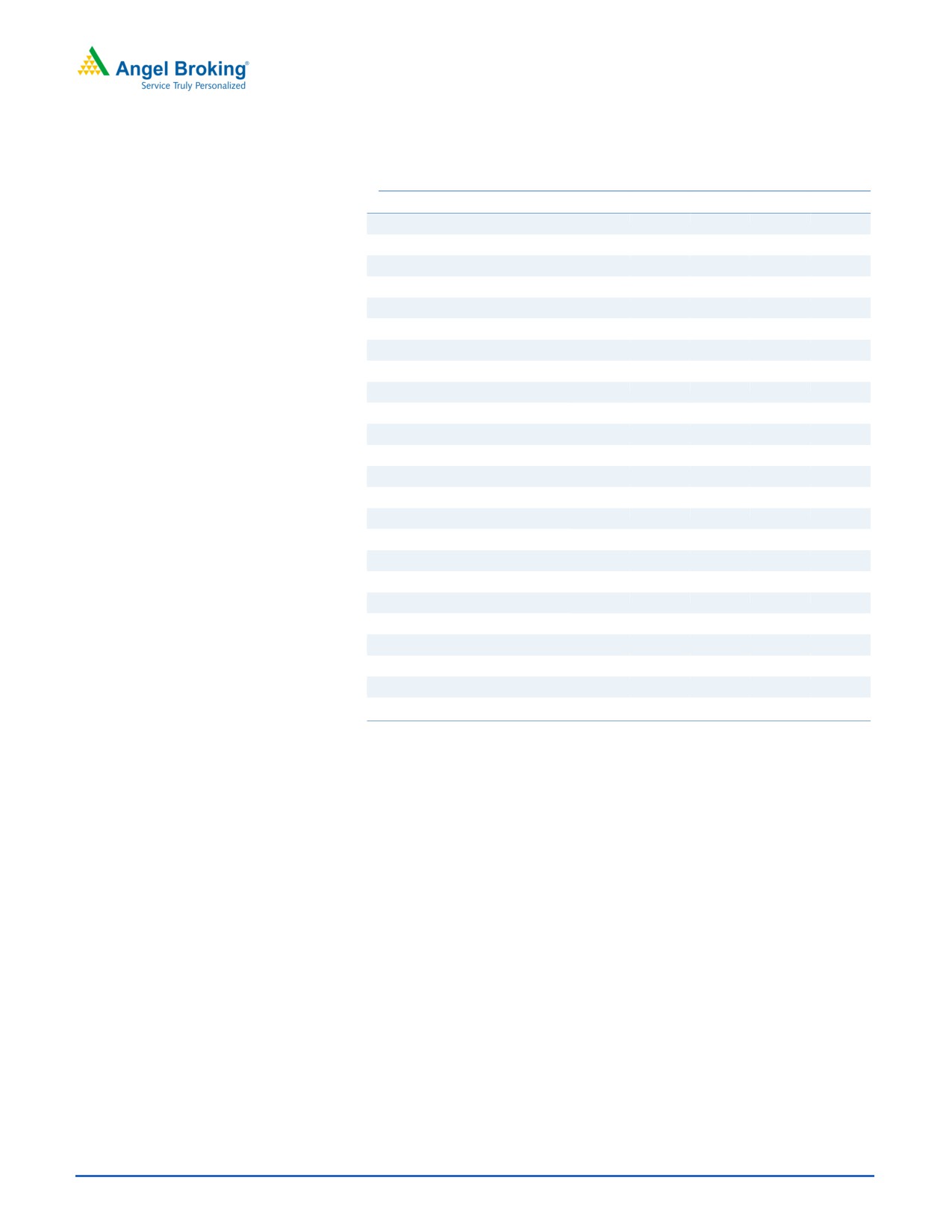

Outlook and Valuation

We forecast RPL to report healthy top-line of ~13% CAGR over FY17-20E on

the back of healthy demand growth in printing & writing paper and Kraft

paper. On the bottom-line front, we estimate ~16% CAGR owing to strong

improvement in operating performance. Further, improvement in

manufacturing efficiency and benefits from increasing global finished paper

prices (ban in China) would aid margins. We initiate coverage on the RPL with

a Buy recommendation and target price of

`244

(11x FY2020E EPS),

indicating an upside of ~30% from the current levels.

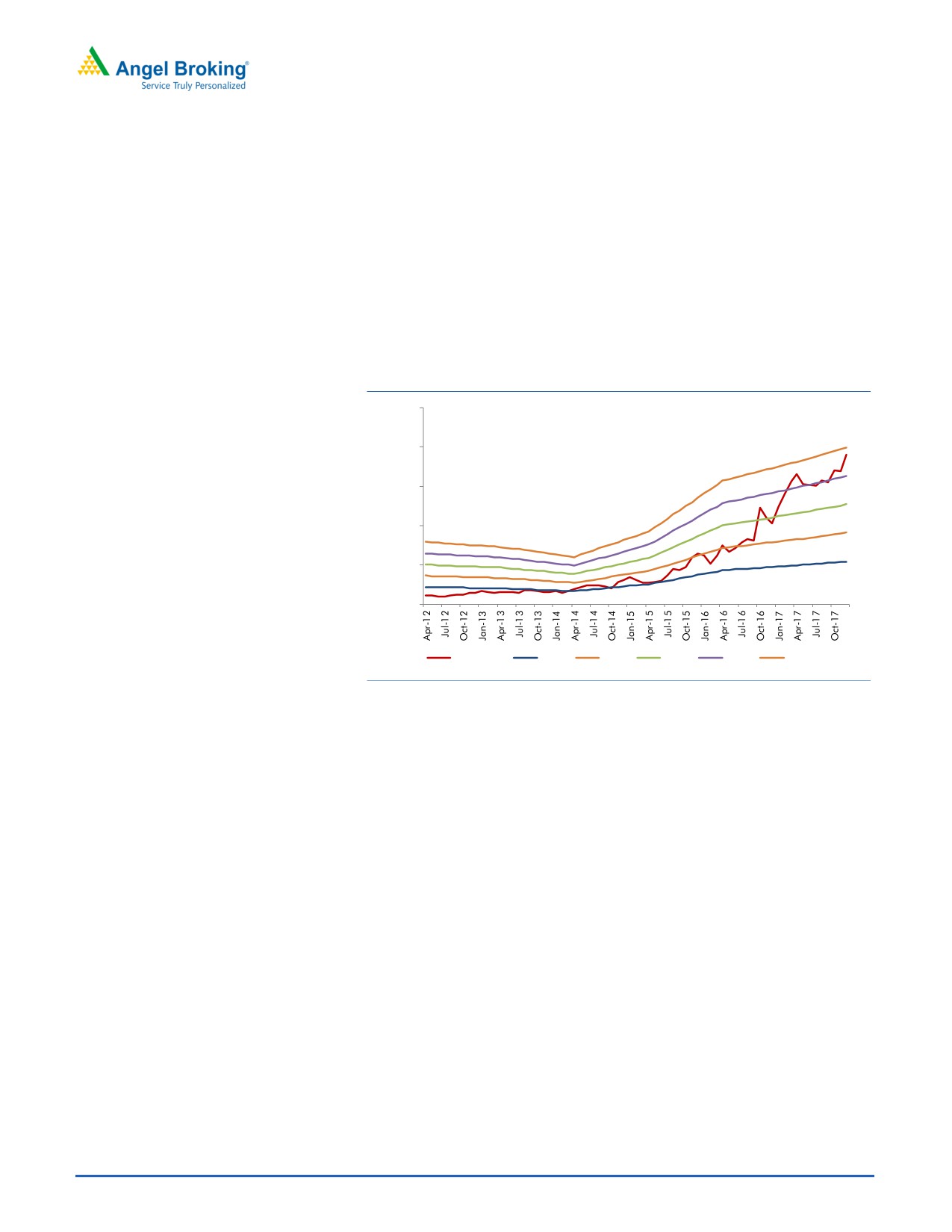

Exhibit 1: One year forward PE chart

250.00

200.00

150.00

100.00

50.00

0.00

Share Price

3.0 X

5.0 X

7.0 X

9.0 X

11.0 X

Source: Company, Angel Research

Risks to our estimates

1) An increase supply of paper would create a surplus in the market, which would

lead to high competition, affecting the overall pricing of paper and hence impact

the company’s profitability

2) Increase in raw material prices (bagasse, wheat straw, rice straw, sarkanda,

etc.) could impact the company’s profitability

December 15, 2017

4

Quick take

Ruchira Papers

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

363

416

470

532

603

% chg

4.6

14.8

12.9

13.3

13.3

Total Expenditure

315

353

397

449

509

Raw Material

233

265

298

338

382

Personnel

30

34

39

44

49

Others Expenses

53

54

60

68

77

EBITDA

47

63

73

83

94

% chg

21.4

33.3

15.9

13.3

13.3

(% of Net Sales)

13.1

15.2

15.6

15.6

15.6

Depreciation& Amortisation

10

11

12

13

13

EBIT

38

53

61

70

81

% chg

28.6

38.7

16.0

14.6

15.2

(% of Net Sales)

10.5

12.7

13.0

13.1

13.4

Interest & other Charges

7

8

8

9

9

Other Income

1

1

1

1

1

(% of PBT)

3.8

2.2

1.8

1.6

1.4

Share in profit of Associates

-

-

-

-

-

Recurring PBT

32

46

54

62

73

% chg

55.4

44.0

18.7

15.0

17.0

Tax

12

14

17

20

23

(% of PBT)

38.7

30.0

32.0

32.0

32.0

PAT (reported)

19

32

37

42

50

Minority Interest (after tax)

-

-

-

-

-

Profit/Loss of Associate Company

-

-

-

-

-

Extraordinary Items

0

(0)

-

-

-

ADJ. PAT

19

32

37

42

50

% chg

51.0

64.9

15.2

15.0

17.0

(% of Net Sales)

5.4

7.7

7.9

8.0

8.2

Basic EPS (`)

8.7

14.3

16.5

19.0

22.2

Fully Diluted EPS (`)

8.7

14.3

16.5

19.0

22.2

% chg

51.0

64.9

15.2

15.0

17.0

December 15, 2017

5

Quick take

Ruchira Papers

Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

22

22

22

22

22

Reserves& Surplus

98

130

162

199

243

Shareholders Funds

121

153

185

222

266

Minority Interest

-

-

-

-

-

Total Loans

73

70

85

85

85

Deferred Tax Liability

27

29

29

29

29

Total Liabilities

221

252

298

335

379

APPLICATION OF FUNDS

Gross Block

274

290

320

332

342

Less: Acc. Depreciation

101

112

124

137

151

Net Block

173

178

196

195

192

Capital Work-in-Progress

-

3

3

3

3

Investments

-

-

-

-

-

Current Assets

94

123

157

193

244

Inventories

41

55

66

77

91

Sundry Debtors

34

44

55

66

78

Cash

2

2

5

13

30

Loans & Advances

17

22

31

37

45

Other Assets

0

0

0

1

1

Current liabilities

47

54

59

58

61

Net Current Assets

47

69

98

136

183

Deferred Tax Asset

1

1

1

1

1

Mis. Exp. not written off

-

-

-

-

-

Total Assets

221

252

298

335

379

December 15, 2017

6

Quick take

Ruchira Papers

Cashflow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

32

46

54

62

73

Depreciation

10

11

12

13

13

Change in Working Capital

2

(18)

(26)

(30)

(30)

Interest / Dividend (Net)

6

7

0

0

0

Direct taxes paid

(8)

(11)

(17)

(20)

(23)

Others

(0)

0

0

0

0

Cash Flow from Operations

40

33

23

26

33

(Inc.)/ Dec. in Fixed Assets

(33)

(20)

(30)

(12)

(10)

(Inc.)/ Dec. in Investments

1

1

0

0

0

Cash Flow from Investing

(32)

(19)

(30)

(12)

(10)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

2

(3)

15

0

0

Dividend Paid (Incl. Tax)

(3)

(3)

(5)

(6)

(6)

Interest / Dividend (Net)

(7)

(8)

0

0

0

Cash Flow from Financing

(9)

(14)

10

(6)

(6)

Inc./(Dec.) in Cash

(0)

0

3

8

17

Opening Cash balances

2

2

2

5

13

Closing Cash balances

2

2

5

13

30

December 15, 2017

7

Quick take

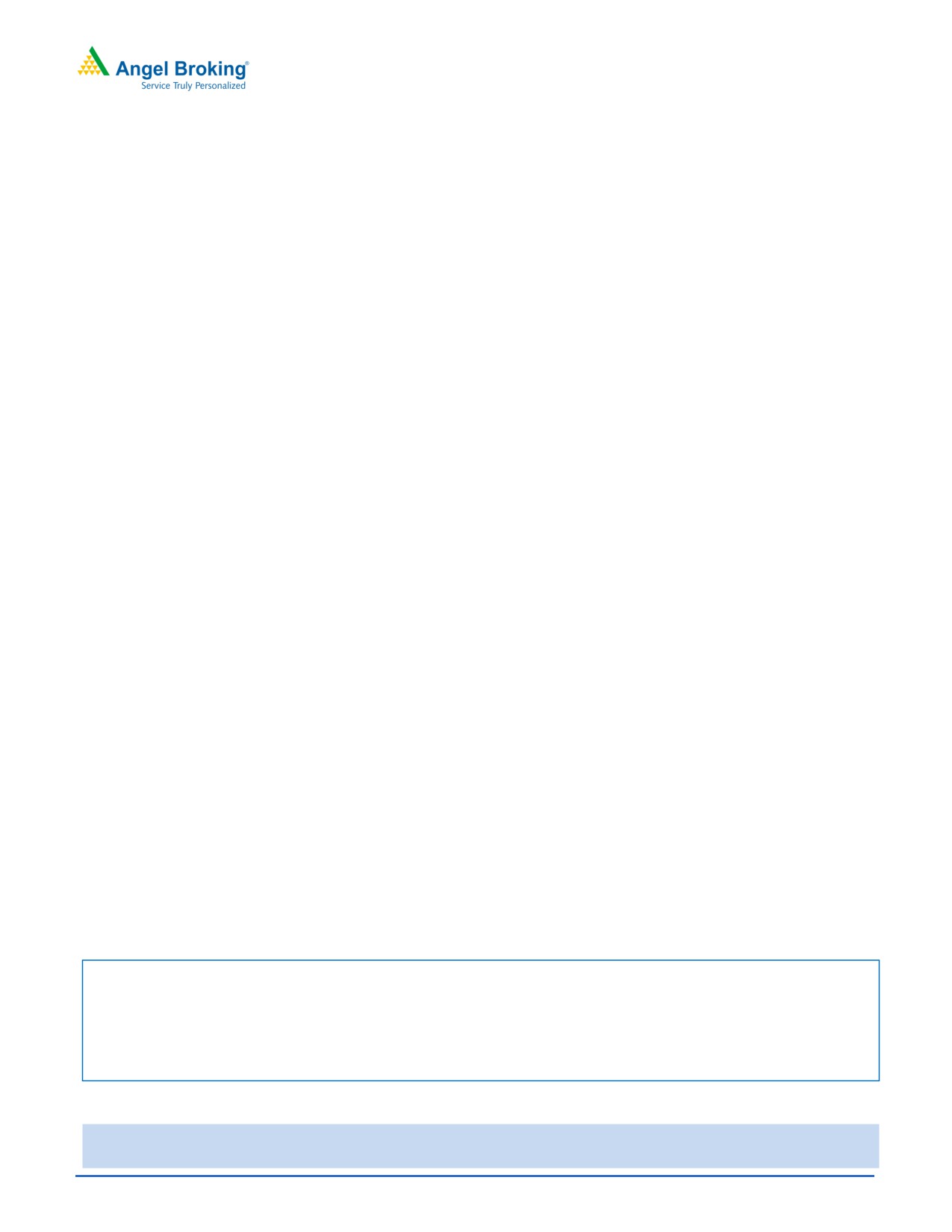

Ruchira Papers

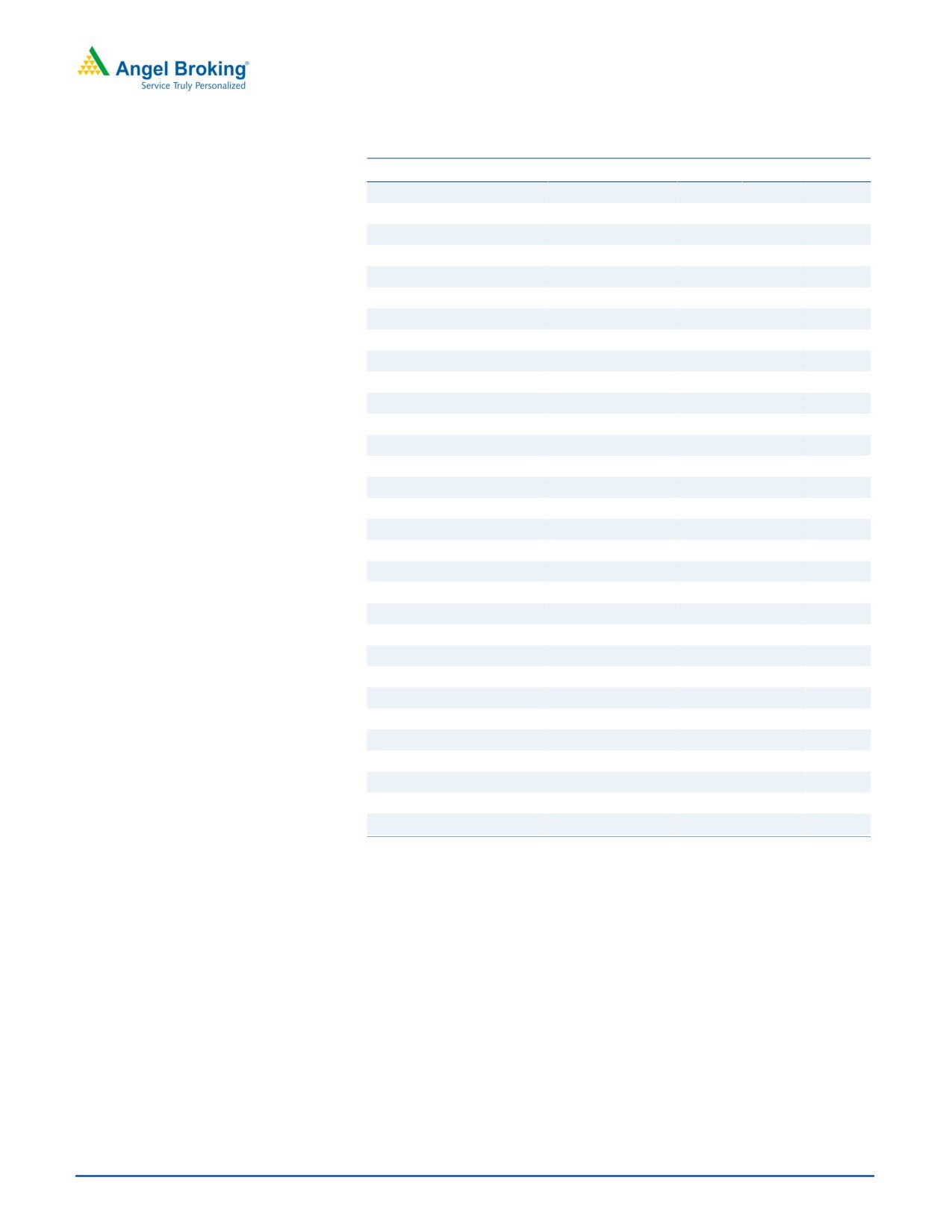

Exhibit 2: Key Ratios

Y/E March

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

21.7

13.1

11.4

9.9

8.5

P/CEPS

14.5

9.9

8.6

7.6

6.7

P/BV

3.5

2.8

2.3

1.9

1.6

Dividend yield (%)

0.7

0.8

1.2

1.3

1.3

EV/Sales

1.4

1.2

1.1

0.9

0.8

EV/EBITDA

10.4

7.7

6.8

5.9

5.1

EV / Total Assets

2.2

1.9

1.7

1.5

1.3

Per Share Data (`)

EPS (Basic)

8.7

14.3

16.5

19.0

22.2

EPS (fully diluted)

8.7

14.3

16.5

19.0

22.2

Cash EPS

12.9

19.0

21.9

24.8

28.2

DPS

1.3

1.5

2.3

2.5

2.5

Book Value

53.8

68.1

82.4

98.8

118.5

Returns (%)

ROCE

19.6

23.6

22.7

22.8

23.0

Angel ROIC (Pre-tax)

19.8

23.8

23.0

23.8

25.1

ROE

16.1

21.0

20.0

19.2

18.7

Turnover ratios (x)

Asset Turnover (Gross Block)

1.3

1.4

1.5

1.6

1.8

Inventory / Sales (days)

41

49

51

53

55

Receivables (days)

35

38

43

45

47

Payables (days)

15

17

15

14

14

Working capital cycle (ex-cash) (days)

61

70

79

84

88

Source: Company, Angel Research

December 15, 2017

8

Quick take

Ruchira Papers

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Ruchira Papers

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

December 15, 2017

9